Ianadmin

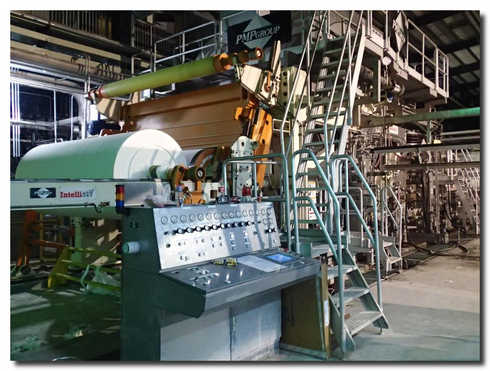

PMP Group’s next Intelli-Tissue® EcoEc 1200 put on stream

It is our pleasure to announce that on October 22nd 2014 PMP Group – a global provider of paper technology – has successfully started up another Intelli-Tissue® 1200 EcoEc machine in China. This time the project was executed for Henan Hulijia Industrial CO., LTD.

Hulijia Group within the last ten years has grown into one of the companies with the most competitive vitality and development potential in the tissue industry in the Henan Province, providing professional nursing products.

The Intelli-Tissue® 1200 EcoEc machine for Henan Hulijia of double-press configuration, of design speed 1200 mpm and a reel trim of 2.85 m produces virgin fiber-based tissue (50 t/d). It is equipped with a modern single-layer hydraulic Intelli-Jet V® headbox, a 4-roll Crescent Intelli-Former®, double nip Intelli-Press®, 12ft ribbed, steel Yankee Dryer Intelli-YD™, exchaust Air Cap and an Intelli-Reel®. Except for premium quality of the final product, the TM is characterized by ultra-low media consumption figures (steam consumption is at a level of 1.7 T/T). Despite its compact size, the Intelli-Tissue® 1200 EcoEc machine can easily replace 10 locally made machines.

PMP’s scope of supply covers i.a. approach flow system, entire tissue machine - including auxiliary systems like lubrication, steam & condensate, mechanical drive,electrical drive and tissue machine controls. The line was designed in Europe and manufactured both in China and Poland. PMP Group is implementing this way Optimum Cost Solution strategy and takes the advantage of the favorable location of its Center of Excellence – PMP IB (Changzhou) Machinery & Technology Co. Ltd.

Mondi celebrates start-up of new recovery boiler at mill in Ružomberok, Slovakia

Construction on the recovery boiler began in 2013 as part of a EUR 128 million investment to increase green electricity production and improve the mill’s overall cost position, while reducing the mill’s environmental footprint.

International packaging and paper group Mondi held a ceremony to celebrate the start-up of a new recovery boiler at Mondi SCP, the company’s operation in Ružomberok, Slovakia. The opening ceremony took place on-site at Mondi SCP, where Slovak Prime Minister Robert Fico joined fellow members of government, the project’s main suppliers, and representatives from owners Mondi Group and ECO-INVEST— the Slovak industrial and investment holding.

International packaging and paper group Mondi held a ceremony to celebrate the start-up of a new recovery boiler at Mondi SCP, the company’s operation in Ružomberok, Slovakia. The opening ceremony took place on-site at Mondi SCP, where Slovak Prime Minister Robert Fico joined fellow members of government, the project’s main suppliers, and representatives from owners Mondi Group and ECO-INVEST— the Slovak industrial and investment holding.

The new recovery boiler (RB3) has replaced recovery boiler 1, marking a further step in the mill’s development to ensure the successful continuation of the mill’s 134 year old tradition of paper making in the region. According to Mondi Group CEO David Hathorn, the start-up of the new recovery boiler will enable more eco-efficient means of increasing the production of pulp at the mill. “Wherever economically and environmentally feasible, Mondi promotes resource efficiency by using innovative technologies and making continuous improvements. In line with this approach, we have committed over €430 million to green energy related projects between 2011 and 2016. RB3 is one of these projects and for us investing in green energy makes good business sense,” said Mr. Hathorn.

A key part of Mondi SCP’s energy efficiency and environmental protection programme, the recovery boiler 3 is part of a broader investment that includes a new turbine, an extended and modernised evaporation plant, and a new lime kiln. Together, these enhancements will also enable the mill to be 100% energy self-sufficient, with 94% of its energy coming from renewable resources.

“Over the past 10 years, the shareholders have invested more than €350 million in Mondi SCP to drive innovative production and operational improvements at the mill. With the new recovery boiler, we are able to produce more pulp with greater efficiency. The new equipment will also lead to a better cost position for our products produced in Ružomberok, making Mondi SCP more competitive in the long term,” explained Peter Orisich, CEO Mondi Uncoated Fine Paper.

“We want to thank the Slovak government for creating an attractive investment environment for international corporations and Slovak investment holdings. This investment brings returns for all involved,” says Miloslav Čurilla, Chairman of the Board of Directors of Mondi SCP.

The project involved 3300 workers, with up to 500 people on site during the peak construction season this spring. 69% of all workers involved in the project were Slovakian nationals.

“The new recovery boiler is a positive step for our continuing presence in the region,” commented Mondi SCP’s Managing Director, Roman Senecky. “Mondi SCP has earned a reputation for sustainable paper production and we are proud to build on that with this investment. In the last year we have worked closely together with the government, our suppliers and partners to bring this project to fruition. We now have the technology to match our expertise – these are important keys to our future.”

The trial operation for the new recovery boiler began on 2 October when the new equipment was successfully tested. The start-up phase has taken place on time and in budget.

Mondi SCP is the largest integrated pulp and paper mill in Slovakia, with a production capacity of 560,000 tonnes of uncoated fine paper, 66,000 tonnes of packaging paper and 100,000 tonnes of market pulp annually. Mondi SCP is the recipient of PPI awards for its Supply Chain (2013), Managing Risk and Safety (2012), Efficiency Improvements of the Year (2012), and Environmental Strategy of the Year (2010). The mill produces well-known brands such as MAESTRO® PRINT, DNS® performance and several IQ and MAESTRO office papers.

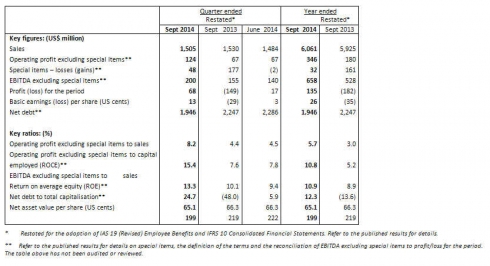

Sappi Q4 and year end result 2014

Sappi Limited results for the year and fourth quarter ended September 2014. Debt below US$2 billion; full year EBITDA excluding special items increase by 25% on strong fourth quarter

Sappi Limited results for the year and fourth quarter ended September 2014. Debt below US$2 billion; full year EBITDA excluding special items increase by 25% on strong fourth quarter

Highlights for the Year

- Strategy delivers strong earnings growth

- EBITDA excluding special items US$658 million (up 25% year-on-year)

- EPS excluding special items 22 US cents (restated 2013 loss per share 4 US cents)

- Net debt US$1,946 million, down US$300 million year-on-year

Highlights for the Quarter

- EBITDA excluding special items US$200 million (up 29% year-on-year)

- EPS excluding special items 12 US cents (restated Q4 2013 1 US cent)

- US$288 million cash generation in the quarter (restated Q4 2013 US$111 million)

Commenting on the key financial highlights of the quarterly and year-end results, Sappi Chief Executive Officer Steve Binnie said:

“We made significant strides in the execution of our strategy this past year. Notable achievements were reduction of net debt, improved performance of our European and Southern African paper businesses and delivery of substantially increased dissolving wood pulp volumes into a growing and high margin market. Additionally, we disposed of Nijmegen Mill in order to reduce costs, and sold our Usutu forests which were surplus to requirements, to assist with reducing net debt. The North American business had a challenging year; however, we can already see advancement in that business and expect further improvement in the year ahead.

The first full year of operation for our expanded Specialised Cellulose operations as well as reduced capex expenditure following the completion of the dissolving wood pulp projects, allowed for a focus on cash generation and debt reduction. The group’s EBITDA excluding special items for the full year increased by 25% over the prior year.

The group continued the strong progress made throughout 2014 and delivered a 29% rise in EBITDA excluding special items compared with the equivalent quarter last year. It is pleasing to note that all three regions improved from the prior quarter. Cost reductions across the group and higher selling prices in some markets contributed to the growth. Volumes continued to decline in the graphic paper markets, but at a slower rate than experienced in recent years.

“The European business saw an encouraging improvement in margin in this seasonally better quarter, achieving an EBITDA excluding special items margin of more than 10% for the first time since 2012.

“In North America, market conditions were extremely competitive throughout the year and we experienced significant downward pressure on pricing. During this seasonally stronger quarter, operating profit excluding special items recovered compared with the prior quarter, which included the impact of outages. The result was slightly below that of the equivalent quarter last year due to lower paper prices and higher input costs, particularly for wood. Prices for coated woodfree web increased during the quarter, but have yet to match prior year price levels. The release paper business was once again impacted by weak Chinese demand, only partially offset by stronger sales to the rest of the world.

“Overall, this has been a good year for the Southern African business, with an expanded Specialised Cellulose business and the restructured paper business consistently delivering enhanced margins. The performance of the Southern African business improved compared to the equivalent quarter last year due to increased sales volumes for dissolving wood pulp, as well as higher average prices for paper and paper packaging.

“The Specialised Cellulose business had another solid quarter, with increased sales volumes and a weaker Rand/Dollar exchange rate offsetting the lower average dollar dissolving wood pulp prices compared to both the prior quarter and prior year. Strong shipment volumes contributed towards an EBITDA excluding special items of US$77 million.

“Based on current market conditions, we believe that EBITDA excluding special items in the 2015 financial year will be broadly similar to that of 2014. The expected improvement in the underlying operational performance of the paper businesses will be offset by lower US Dollar dissolving wood pulp pricing and the impact of the projects at Gratkorn and Somerset.

“The first quarter result will be negatively impacted by the Gratkorn PM11 upgrade project, resulting in three weeks of downtime for the paper machine. The results will be further impacted by the extended annual maintenance outage and the finalisation of the natural gas conversion project at Somerset Mill in the US.

“We therefore expect the group EBITDA excluding special items in the first quarter to be similar to that achieved in the equivalent quarter last year, despite the improved underlying performance of the overall business.”

click image to resize

The year and quarter under review

Operating profit excluding special items for the year was US$346 million compared to US$180 million in the prior year. Special items amounted to a charge of US$32 million, comprised mainly of net restructuring charges and loss on disposal of assets across our businesses. This was partially offset by plantation fair value pricing gains of US$18 million.

Special items for the quarter were a net charge of US$48 million. Included in the special items was a provision for retrenchments and restructuring costs in our European paper business. These charges were offset by a deferred tax asset of US$53 million in North America which was recognised due to the non-taxability of bio-fuel tax credits received in fiscal 2009 and 2010.

Earnings per share for the quarter were 13 US cents (including a gain of 1 US cent in respect of special items), compared with a loss of 29 US cents (including a charge of 30 US cents in respect of special items) in the restated equivalent quarter last year.

Net cash generated for the full financial year was US$243 million compared to utilisation of US$247 million last year. This significant turnaround was due to the improved operating cash generation, excellent working capital management, reduced capital expenditure and the receipt of proceeds of ZAR1 billion from the sale of the Usutu forests.

Net debt at financial year-end decreased to US$1,946 million as a result of the increased cash generated, and was within our target to end the year below US$2 billion. At the end of September 2014, we had liquidity comprising US$528 million of cash in addition to undrawn committed revolving credit facilities of €350 million and ZAR1 billion in Europe and South Africa respectively. In October 2014, we utilised cash resources to redeem US$27 million (ZAR300 million) of our US$67 million (ZAR750 million) public bonds due April 2015.

Outlook

Markets will remain challenging, both for graphic paper, where demand is expected to continue to decline, and for dissolving wood pulp due to current pricing pressures. In the dissolving wood pulp market, demand remains robust. US Dollar prices have weakened post the financial year due to pressure from lower cotton prices and the continued oversupply of dissolving wood pulp and viscose staple fibre production capacity. Cloquet Mill will likely take advantage of its ability to swing between dissolving pulp and hardwood paper pulp production to optimise margins for the US business. Volumes with key dissolving wood pulp customers will not be impacted by any such optimisation. We will continue to focus on cost management in order to maintain our current margins for the overall Specialised Cellulose business.

Currency movements affect margins in our European and Southern African businesses, having both transactional and translational impacts. A weaker Rand and Euro in relation to the US dollar both support local and export pricing for these businesses, historically offsetting any input cost impact of the weaker currency.

Capital expenditure in 2015 is expected to be in line with that of 2014, and focussed largely on the investments at our Kirkniemi and Gratkorn Mills.

We are considering utilising our increased cash reserves to repay and refinance a portion of our debt in order to lower future costs. We typically experience a cash outflow in our first fiscal quarter and this will lead to an increase in net debt as at the end of December 2014. Nevertheless, we expect to reduce our net debt further over the course of the year and reduce our financial leverage towards our target of two times net debt to EBITDA.

Road-trip concept for Spotify wins packaging competition

A pop-up store made from BillerudKorsnäs material and designed for use in petrol stations has won the top prize when students from Berghs School of Communication competed to package the digital music service Spotify.

Throughout autumn, students at Berghs School of Communication have been participating in a contest to find the best analogue packaging solution for the digital music service Spotify. The competition, dubbed SPICE:14, was held across September and October in partnership between Berghs, Spotify and BillerudKorsnäs.

Road Trip winner

A total of 12 teams participated in the event, each presenting Spotify with two solutions to make a total of 24 entries. The winning concept is called Spotify Road Trip and centres on a pop-up store that can be placed in petrol stations. The idea behind the concept was to exploit the fact that petrol stations are not simply places to refuel, but also environments where customers purchase items to make their car journeys more pleasant.

The team behind the winning concept comprises project managers Sofia Göthlin and Richard Holmquist and graphic designers Sofie Redtzer and Malin Strömblad.

"We were a bit puzzled by the brief," says Holmquist. "How could we make a physical packaging for a digital service? It really forced us to think outside the box."

Benefits for Spotify and BillerudKorsnäs

According to the prize jury, the winning concept shows a clear understanding of users and of the target audience’s emotional drives. It also embodies direct problem-solving and simple distribution, while completely meeting the brief.

Jenny Hermansson is Business Director at Spotify and a member of the jury.

"The winning concept has a clear understanding and a good idea," she says. "We believe in the target group and the concept is nicely packaged. It was also a fierce competition with lots of very good ideas. I’m confident that we will be able to realise a number of the concepts and we are very pleased with the competition."

The competition was run by Jimmy Nyström, Business Development Director, BillerudKorsnäs and Jon Haag, Corporate Innovation Manager, BillerudKorsnäs.

"As managers for the project, we think this year’s competition has reached an entirely new level. The students have worked really hard for six weeks and are presenting concepts that are fully up to the standard of what’s provided by creative agencies. We’re impressed!"

This year’s SPICE:14 competition was the fifth to be held, and it has expanded from a competition for Berghs student to being an integrated part of the Sustainable Packaging Design class at the school.

Read more about SPICE:14 at www.spice14.com

For more information, please contact:

Jon Haag, Corporate Innovation Manager, BillerudKorsnäs

+46 702072557, This email address is being protected from spambots. You need JavaScript enabled to view it.

Jimmy Nyström, Business Development Director, BillerudKorsnäs

+46 703832442 This email address is being protected from spambots. You need JavaScript enabled to view it.

Pål Pettersson, Head of Graphic Design, Berghs School of Communication.

+46 792540239, This email address is being protected from spambots. You need JavaScript enabled to view it.

![]() BillerudKorsnäs provides high quality paper and state of the art packaging expertise. Together with our global network of converters we develop smarter packaging solutions that save costs, boost brands thanks to improved design, and contribute towards smoother logistics and a cleaner environment. We have a turnover of SEK20 billion and employ 4,300 people in 13 countries.’www.billerudkorsnas.com

BillerudKorsnäs provides high quality paper and state of the art packaging expertise. Together with our global network of converters we develop smarter packaging solutions that save costs, boost brands thanks to improved design, and contribute towards smoother logistics and a cleaner environment. We have a turnover of SEK20 billion and employ 4,300 people in 13 countries.’www.billerudkorsnas.com

Domtar wins 2014 two AF&PA Sustainability Awards

Domtar Corporation (NYSE: UFS) (TSX: UFS) was recognized by the American Forest & Paper Association as a leader in sustainability with two 2014 AF&PA Sustainability Awards. This is the second consecutive year Domtar has been honored for its sustainability advancements.

Domtar Corporation (NYSE: UFS) (TSX: UFS) was recognized by the American Forest & Paper Association as a leader in sustainability with two 2014 AF&PA Sustainability Awards. This is the second consecutive year Domtar has been honored for its sustainability advancements.

Domtar received the Innovation in Sustainability Award for their BioChoiceTM Lignin and the Leadership in Sustainability Award for Energy Efficiency and Greenhouse Gas (GHG) Reductions for their Barge Unloading and Conveyor Project. Designed to recognize exemplary sustainability programs and initiatives in the paper and wood products manufacturing industry, the annual sustainability awards are given based on the merit of entries received across multiple categories.

Domtar leveraged its Plymouth, N.C. mill's existing infrastructure to start a lignin separation plant - the first of its kind in North America in over 25 years. Lignin is the natural glue that holds wood fibers together. While it is most commonly used as a carbon-neutral source of fuel, modern technology allows it to be made into a wide range of sustainable products, including coating, natural binders, plastics and resins.

Domtar's one-mile-long conveyor belt from the banks of the Ohio River straight into their Hawesville, Ky. Mill enabled them to directly deliver wood chips to the mill, eliminating 54,000 wood chip delivery truck trips and drastically reducing truck traffic and related congestion and pollution.

"We are honored to be recognized by AF&PA, underscoring Domtar's commitment to its core values of innovation and caring, optimizing our processes and with this year's Innovation in Sustainability Award and Leadership in Sustainability Award for Energy Efficiency and Greenhouse Gas Reductions. Innovation is one of Domtar's core values, and in this case it has helped make our company more efficient," said Domtar President and CEO John Williams.

About Domtar

Domtar Corporation (NYSE: UFS) (TSX: UFS) designs, manufactures, markets and distributes a wide variety of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products. The foundation of its business is a network of world class wood fiber converting assets that produce papergrade, fluff and specialty pulps. The majority of its pulp production is consumed internally to manufacture paper and consumer products. Domtar is the largest integrated marketer of uncoated freesheet paper in North America with recognized brands such as Cougar®, Lynx® Opaque Ultra, Husky ® Opaque Offset, First Choice® and Domtar EarthChoice® . Domtar is also a leading marketer and producer of a broad line of absorbent hygiene products marketed primarily under the Attends® , IncoPack and Indasec® brand names. In 2013, Domtar had sales of $5.4 billion from some 50 countries. The Company employs approximately 10,000 people. To learn more, visit www.domtar.com.

SOURCE Domtar Corporation

From Carnaby Street to global recognition

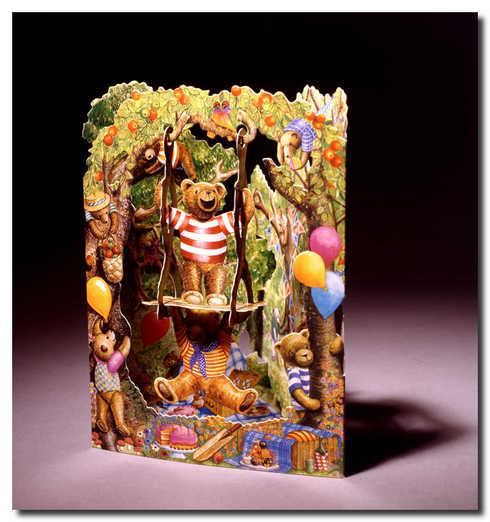

It all began with a small design studio on a little road off Carnaby Street. SANTORO was Lucio and Meera Santoro’s small-scale venture into innovative graphic design. Today their work is found around the world and they have won some 50 international awards for their designs, greeting cards and 3D books.

The company’s first big success came with its Swing Cards, a series of movable 3D greeting cards which are sent flat but which unfold themselves immediately they are removed from the envelope. Over the years the collection has gradually expanded and now consists of more than 90 different cards, which are sold world-wide, with over 15 million recipients to date.

“If I’d realised how much work is involved in every card I never would have started this,” commented Lucio Santoro in the company’s showroom at the current headquarters at Rotunda Point in Wimbledon. “This must be the highest level of construction using paper materials.”

“But at the same time, the demanding construction work has also protected us from copies and plagiarists. There are many other products which are far easier to copy.”

It was while working on the original Swing Cards collection during the first half of the 1990s that the studio first encountered the paperboard called Invercote made by Iggesund Paperboard. Since then all the studio’s advanced collections have been made using Invercote.

“Invercote maintains a very high and consistent quality,” Lucio Santoro said. “For our purposes, though, a few of its unusual features are the most important. Its very high tear resistance enables us to create finer details while at the same time the construction is more durable.

“Another important property is dimensional stability. Few people realise that when you are working in three dimensions you not only have to ensure perfect registration between the printing inks but also with the printed image on the reverse. Dimensional stability is crucial for this.”

Over time SANTORO has built up a portfolio of designs, which the studio now licenses to other users, an activity that currently brings in almost half the company’s revenues. Designs by Santoro are now printed on everything from bags and gift articles to housewares, notebooks, ceramics, apparel and footwear to name just a few. Lucio and Meera have also produced three 3D non-fiction books: Journey to the Moon, Wild Oceans and Predators.

Sophisticated greeting cards are still an important part of SANTORO’s business. Last year the company launched its Pirouettes collection, which has good prospects of emulating the popularity of the Swing Cards.

“We believe strongly in Pirouettes – you have to when it takes about two years to develop a collection,” Lucio said. “Sales have gone well so far but it will be a few years before we can see how the collection measures up to Swing Cards’ twenty years of popularity.”

About 30 people work at SANTORO’s design studio in London, with a further 60 employees around the world.

Caption: “Invercote’s tear resistance and dimensional stability are incredibly important to us as a company making sophisticated moveable constructions from paper material,” said Lucio Santoro, who together with Meera Santoro founded SANTORO in 1985. © Iggesund

Iggesund

Iggesund Paperboard is part of the Swedish forest industry group Holmen, one of the world’s 100 most sustainable companies listed on the United Nations Global Compact Index. Iggesund’s turnover is just over €500 million and its flagship product Invercote is sold in more than 100 countries. The company has two brand families, Invercote and Incada, both positioned at the high end of their respective segments. Since 2010 Iggesund has invested more than €380 million to increase its energy efficiency and reduce the fossil emissions from its production.

Iggesund and the Holmen Group report all their fossil carbon emissions to the Carbon Disclosure Project. The environmental data form an integral part of an annual report that complies with the Global Reporting Initiative’s highest level of sustainability reporting. Iggesund was founded as an iron mill in 1685, but has been making paperboard for more than 50 years. The two mills, in northern Sweden and northern England employ 1500 people.

Further information:

Staffan Sjöberg

Public Relations Manager

This email address is being protected from spambots. You need JavaScript enabled to view it.

Iggesund Paperboard

SE-825 80 Sweden

Tel: +4665028256

Mobile: +46703064800

www.iggesund.com

Sonoco's Newport Paper Mill Receives Bronze Sustainability Star Award

Sonoco (NYSE:SON), one of the largest diversified packaging companies, has named the Company's Newport, Tennessee, paper mill a bronze Sonoco Sustainability Star Award recipient for the facility's efforts to significantly decrease wastes going to landfill.

Sonoco (NYSE:SON), one of the largest diversified packaging companies, has named the Company's Newport, Tennessee, paper mill a bronze Sonoco Sustainability Star Award recipient for the facility's efforts to significantly decrease wastes going to landfill.

The award marks a milestone in landfill-free efforts that have been underway since the fourth quarter of 2012. In late 2012, the Newport facility partnered with local recycling company TLR Solutions to process some of the more difficult to recycle byproducts of the mill's operations, like bailing wire and materials such as glass, staples and ceramics that are sorted out from incoming paper fiber.

"After the company announced its goal of taking 10 percent of its facilities landfill free, we began efforts to eliminate the facility's waste streams," said Marty Pignone, vice president, Paper North America. "The Newport paper mill has made significant advances—recycling almost 20 percent of waste that previously went to landfill each month—and we look forward to continuing those efforts."

Many of the items collected by TLR Solutions for processing require very specific equipment. The recycling company not only found nearby locations with equipment capable of handling the materials, but also worked with those locations for over a year to identify the correct processes for recycling—many some of the first of their kind in North America.

Administered by Sonoco Recycling, the Company's recycling business, the Sonoco Sustainability Star Awards program is comprised of three tiers:

- Gold recognizes facilities that have achieved 99% landfill diversion.

- Silver is awarded to facilities achieving 95% landfill diversion, and

- Bronze recognizes facilities that have made significant waste reduction achievements, such as drastically reducing their waste streams or implementing a new composting system.

A recycling leader with locations and expertise worldwide, Sonoco Recycling annually collects more than 3 million tons of old corrugated containers, various grades of paper, metals and plastics. In addition, the Company has experts who provide secure, reliable and innovative recycling solutions to residential and commercial customers. Currently, Sonoco Recycling operates five material recovery facilities (MRFs) serving more than 125 communities in which curbside-collected residential and commercial materials are processed. The Company also operates recycling programs which identify waste reduction opportunities that reduce operating expenses for many of the largest consumer product companies in the United States.

About Sonoco:

Founded in 1899, Sonoco is a global provider of a variety of consumer packaging, industrial products, protective packaging, and displays and packaging supply chain services. With annualized combined sales of approximately $5.4 billion, the Company has more than 21,000 employees working in more than 340 operations in 34 countries, serving some of the world's best known brands in some 85 nations. Sonoco is a proud member of the 2014/2015 Dow Jones Sustainability World Index. For more information on the Company, visit our website at www.sonoco.com.

CONTACT: Brett Turner

+843-383-7794

This email address is being protected from spambots. You need JavaScript enabled to view it. Significantly better efficiency: The new NASH 2BE5 series

A vacuum level down to 100 mbar abs. and improved efficiency of up to 10%: with its new NASH 2BE5 series, Gardner Denver Nash is extending its competence in the market for liquid ring pumps with high gas flow rates.

The NASH 2BE5 has been launched to build on the proven NASH 2BE4 series, further improving its already impressive performance. The development goal was to optimize and extend the performance the vacuum range below 300 mbar abs. The result: The new NASH 2BE5 series pumps are able to achieve vacuum levels down to 100 mbar abs.

This is made possible primarily by optimization of the gas flow. The patented gas scavenger provides increased vacuum capacity and, consequently, a significant improvement in terms of efficiency. Compared to the basic 2BE4 model, water consumption in the once-through mode has been reduced by up to 25%. Improved fluid self-recirculation eliminates the need for booster pumps, which in turn creates greater energy savings.

Service aspects were also taken into consideration during the 2BE5 development: Removable bearing brackets simplify on-site maintenance and help to reduce repair times. Rigidity is improved by bolt connections of the body and side shield, producing an optimum seal in compressor operation. Certification to ATEX is already in the pipeline, making this pump also suitable for use in potentially explosive atmospheres.

The NASH 2BE5 series can be used both as a vacuum pump and a compressor. For vacuum generation, suction capacities are between 2500 and 32000 m³/h, reaching down to 100 mbar abs of vacuum. When used as a compressor, they achieve between 3000 and 9500 m³/h with compression of up to 2.5 bar abs.

In terms of their outer dimensions, footprint and port sizes, the NASH 2BE5 series is identical to the basic NASH 2BE4 model, making it simple to upgrade to a new, more efficient machine at any time.

The NASH 2BE5 series has been consistently developed in line with the wide- ranging requirements of the process industry. Two material options and a wide range of material combinations have made this an adaptable pump capable of addressing a wide spectrum of applications. The NASH 2BE5 is available in ductile iron and stainless steel, or a combination of these two materials. In ductile iron, the body is always supplied with a polyisoprene lining. This allows the series to be used in wide-ranging types of applications across many sectors of industry, including chemical process engineering, filtration applications, the pulp and paper industry, in power plants, refineries and many others.

About the company:

Gardner Denver Nash is the “Nash Division” of Gardner Denver, Inc. Originating from nash_elmo Industries, the company is the world's leading manufacturer of liquid ring vacuum pumps, compressors and engineered systems. For more than 100 years, Gardner Denver Nash has engineered and produced liquid ring pumps and vacuum and compressor systems for the most demanding applications in a variety of fields and industries.

Per Lundeen has been appointed acting CEO of Rottneros AB and Carl-Johan Jonsson leaves

Rottneros AB (publ) hereby announces that Carl-Johan Jonsson with immediate effect leaves the company and is replaced by the board member Per Lundeen as acting CEO. The recruitment process for a permanent CEO has been initiated.

Rottneros AB (publ) hereby announces that Carl-Johan Jonsson with immediate effect leaves the company and is replaced by the board member Per Lundeen as acting CEO. The recruitment process for a permanent CEO has been initiated.

”Rottneros is developing positively and the profit improvement program, Fokus 15, that was initiated by the board will continue. The change of leadership is based on different views on leadership and organizational development”, says Rune Ingvarsson, chairman of the board, Rottneros.

Per Lundeen is a member of the board of Rottneros since 2013. Per Lundeen has a Master of Science from Chalmers University of Technology and long experience from management roles, especially in the packaging and paper converting industry. Among others Per Lundeen was the CEO at Å&R Packaging from 2000 to 2012.

For more information please contact:

Rune Ingvarsson, Chairman of the Board of Rottneros AB, telephone +46 702887976

Rottneros discloses the information provided herein pursuant to the Securities Markets Act and/or the Financial Instruments Trading Act. The Information was submitted for publication on Thursday 6:th of November 2014 at 14:00.

Rottneros is an independent producer of market pulp. The Group comprises the parent company Rottneros AB, listed on NASDAQ OMX Stockholm, and its subsidiaries Rottneros Bruk AB and Vallviks Bruk AB with operations involving the production and sale of market pulp. The Group also includes the wood procurement company Rottneros Baltic SIA in Latvia. The Group has approximately 250 employees and had a turnover of approximately SEK 1.4 billion in the 2013 financial year.

Stora Enso: New DuoDry CC drying concept from Voith impresses in operation

DuoDry CC, the innovative drying concept from Voith, is for the first time successfully in operation. The DuoDry CC is delivered and installed in the Narew PM 5 at Stora Enso in Ostroleka, Poland. The concept impresses with its reduced curl formation caused by the drying process and lowers energy demand by increased runability of the paper machine.

CC stands for curl control and designates the latest technology for reducing curl in single-tier dryer sections, which have become especially popular on the market since the speeds of paper machines have increased. The advantage of single-tier design when compared to the two-tiered design is that the machine achieves improved runability. However, a disadvantage of the conventional single-tier design is that the paper tends to curl due to the one-sided drying.

DuoDry CC solves this problem with a smart concept that is as effective as it is simple – a vertically inverted single-tier dryer group that serves as the last group. Normally the paper web is sprayed with water on one side to fight curl. The web is dried again afterward through additional energy input. With DuoDry CC, by contrast, the thermal energy already required for drying the paper web is utilized by being fed into the inverted dryer group from the other side. Thus no additional energy is required for reducing curl. Use of this technology reduces the operating costs of the paper machine. The components used, such as web stabilizers and dryer cylinders, are products that have long been proven, which ensures the reliability of the system in operation.

Janne Myllykangas, PM area manager at Stora Enso, confirmed after the project was finalized: “The collaboration with Voith was very good. The trust formed during the negotiations has been confirmed in the execution. The decision in favor of the DuoDry CC drying system has also proved to be the right one. We are very satisfied with the performance of DuoDry CC in operation.”

The Narew PM 5 from Voith is equipped with a SpeedSizer and produces 455,000 metric tons of testliner and corrugating medium per year on a wire width of 8,600 mm.

Further information is available on the Voith website at www.voith.com/paper. Voith Paper is also on Twitter and YouTube.

Voith Paper is a division of the Voith Group and the leading partner to and pioneer in the paper industry. Through constant innovations, Voith Paper is optimizing the paper manufacturing process, focusing on developing resource-saving products to reduce the use of energy, water, and fibers. Furthermore, Voith Paper offers a broad service portfolio for all sections of the paper manufacturing process.

Voith sets standards in the markets energy, oil & gas, paper, raw materials and transport & automotive. Founded in 1867, Voith employs more than 43,000 people, generates € 5.7 billion in sales, operates in about 50 countries around the world and is today one of the biggest family-owned companies in Europe.