Metsä Board Corporation Interim Report 1 January–30 September 2012, 1 November 2012 at 12 noon

Result for January–September 2012

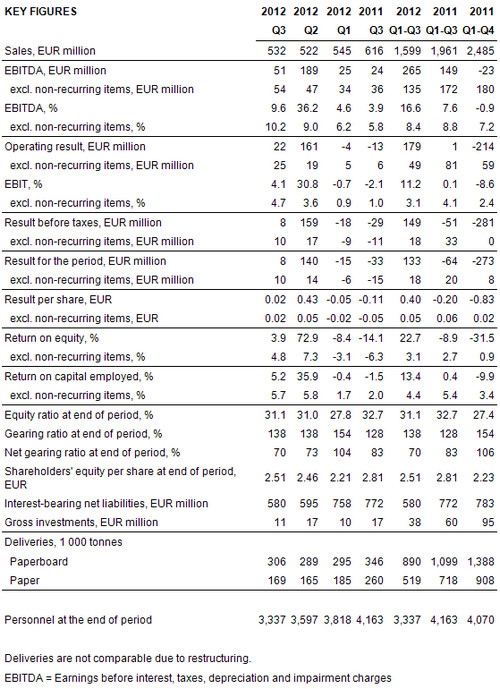

- Sales were EUR 1,599 million (Q1–Q3/2011: 1,961).

- The operating result excluding non-recurring items was EUR 49 million (81). The operating result including non-recurring items was EUR 179 million (1).

- The result before taxes excluding non-recurring items was EUR 18 million (33). The result before taxes including non-recurring items was EUR 149 million (-51).

- Earnings per share excluding non-recurring items were EUR 0.05 (0.06) and including non-recurring items EUR 0.40 (-0.20).

Result for the third quarter of 2012

- Sales were EUR 532 million (Q2/2012: 522).

- The operating result excluding non-recurring items was EUR 25 million (19). The operating result including non-recurring items was EUR 22 million (161).

- The result before taxes excluding non-recurring items was EUR 10 million (17). The result before taxes including non-recurring items was EUR 8 million (159).

- Earnings per share excluding non-recurring items were EUR 0.02 (0.05) and including non-recurring items EUR 0.02 (0.43).

Events in the third quarter of 2012

- Delivery volumes of paperboard and coated paper increased.

- Delivery volumes of uncoated paper and pulp decreased.

- There were no material changes in paper and paperboard prices. The market price of pulp decreased.

Events after the period

- The biopower plant owned by Pohjolan Voima and Leppäkosken Sähkö was inaugurated at the Kyro mill.

“Our profitability improved further in the third quarter. Favourable development in the paperboard business continued, and delivery volumes increased as expected. Despite the extensive maintenance shutdown at the Husum mill, the operating result of the paper and pulp business remained at the second quarter level.

The paper and paperboard order books and operating rates are currently at a normal level. Folding boxboard order inflows have in recent weeks slowed down somewhat, but the price situation is stable. Paperboard delivery volumes are estimated to be slightly lower in the fourth quarter than in the third quarter, due to seasonal factors. Market prices of pulp are expected to increase in the fourth quarter, but it is estimated that the average price of deliveries will be slightly lower than in the third quarter. The overall situation in the global economy is currently uncertain, which makes business forecasting more difficult than in normal conditions.

We completed the Paperboard business area’s investment programme as planned with the inauguration of the biopower plant at the Kyro mill. Our production machinery is now top class in the world, and our folding boxboard capacity, which was expanded by 150,000 annual tonnes, will be fully available from the beginning of 2013. New capacity is necessary in order for us to ensure the availability of board for our customers in all situations.”

Mikko Helander, CEO

Near-term outlook

The situation in the global economy is currently uncertain, which makes business forecasting more difficult than in normal conditions.

Folding boxboard order books and operating rates are currently at a normal level, but the order inflows have recently slowed down somewhat. The average prices of folding boxboard are not expected to change materially in the coming months.

Linerboard order books and operating rates are at a strong level. Prices of linerboard will be slightly higher in the fourth quarter than in the third quarter, as a result of the price increase implemented in September.

It is estimated that in the fourth quarter the delivery volume of folding boxboard and linerboard will be slightly lower than in the third quarter, due to the seasonally weaker December. The slight increase in the price of linerboard is, however, not estimated to be sufficient to completely cover the negative result impact of the seasonally lower delivery volumes in the fourth quarter in the Paperboard business area.

The delivery volumes of paper and pulp are in the fourth quarter expected to be at least at the third quarter level. No material changes are on the horizon in paper prices. The USD denominated market price of long fibre pulp is estimated to increase somewhat during the fourth quarter. All in all, the average price of Metsä Board’s pulp deliveries in the fourth quarter is however estimated to be slightly lower than in the third quarter.

Production costs are not estimated to change materially in the coming months.

Metsä Board’s operating result in the fourth quarter of 2012, excluding non-recurring items, is expected to be roughly at the third quarter of 2012 level.

Disclosure procedure

Metsä Board Corporation follows the disclosure procedure enabled by Standard 5.2b published by the Finnish Financial Supervision Authority and hereby publishes its Interim Report for January-September 2012 enclosed to this stock exchange release. Metsä Board's complete Interim Report is attached to this release in pdf-format and is also available on the company's web site at www.metsaboard.com.